Employee Onboarding

NoteBefore you onboard an employee, you should define where they will be working. Follow the Work Locations Guide to do so.

Onboarding W-2 Employees is an important step for any payroll offering. There are a lot of factors that determine an employee’s taxable status which is necessary to pay them correctly. As such, there are a few steps involved with onboarding an employee.

In this guide

- How to get an employee's Work Location

- How to create an Employee

- How to complete Tax paperwork

- How to add an employee's Bank Account

- How to update an employee's onboarded status

- How to onboard an employee using the white-label components

API

Get the employee's Work Location

Call Get Work Locations and find the Work Location for this employee. Store the workLocationID.

NoteRemember to replace the placeholders such as

{{testApiKey}}in the code samples below.

curl --request GET \

--url https://api.zeal.com/workLocations \

--header 'Accept: application/json' \

--header 'Authorization: Bearer {{testApiKey}}'Create an Employee

Call Create Employee with the employee data along with the companyID and workLocationID.

curl --request POST \

--url https://api.zeal.com/employees \

--header 'Accept: application/json' \

--header 'Authorization: Bearer {{testApiKey}}' \

--header 'Content-Type: application/json' \

--data-raw '

{

"new_employees": [

{

"overtime_rate": 1.5,

"double_time_rate": 2,

"autopilot": {

"autopilot_on": false

},

"is_943": false,

"is_scheduleH": false,

"email": "[email protected]",

"first_name": "Richard",

"last_name": "Hendricks",

"title": "CEO",

"default_pay_schedule": "semimonthly",

"default_wage": 50,

"workLocationID": "{{workLocationID}}",

"start_date": "2022-01-01",

"dob": "1985-05-25",

"ssn": "123456789",

"phone_number": "1234567890",

"address": "1 Market St.",

"city": "San Francisco",

"state": "CA",

"zip": "94110"

}

],

"companyID": "{{companyID}}"

}

'Store the employeeID or IDs from the employee objects returned.

W4s: Fetching Paperwork Templates

Tax Paperwork information (most commonly W4 information) can be sent to Zeal using the Paperwork endpoints.

Note: if you don't submit W4 information for an employee, Zeal will use the default tax parameters based on work and residency location of the worker.

The Paperwork Template object outlines the fields that represent a Paperwork Template, which includes key information such as the name of the form, the applicable jurisdiction(s), and the fields on the form. For the purposes of this guide, we will be focusing on Paperwork Templates with paperwork_type as W4.

Paperwork Templates can be fetched using the Get Paperwork Template. Be sure to include the jurisdiction(s) and the effective date for the W4 form(s) you want to retrieve.

curl --request POST \

--url https://api.zeal.com/paperwork/templates \

--header 'accept: application/json' \

--header 'content-type: application/json' \

--data '

{

"companyID": "fc235fcccee46aa8a082f357715bcfa",

"paperwork_type": "W4",

"worker_type": "Employee",

"jurisdictions": {

"type": "include",

"jurisdictions": [

"CA"

]

},

"jurisdiction_type": "WorkLocation",

"effective_date": "2023-07-01"

}

'This will return the templateID for the California W4 that you will need when creating a Submission. Here is an example response:

{

"templates": [

{

"templateID": "template_123456",

"companyID": "fc235fcccee46aa8a082f357715bcfa",

"form_name": "W-4 Form",

"description": "Employee's Withholding Certificate",

"paperwork_type": "W4",

"worker_type": "Employee",

"jurisdictions_filter": {

"type": "include",

"jurisdictions": [

"CA"

]

},

"jurisdiction_type": "WorkLocation",

"effective_date": "2023-07-01",

"archive_date": null,

"form_fields": [

{

"field_name": "employee_name",

"label": "Employee's Full Name",

"type": "string",

"required": true

}

],

"urls": [

"https://example.com/w4_form.pdf"

],

"status": "Live"

}

]

}Note that the Paperwork Template also includes a URL containing the form in case you want to show a worker what they are filling out.

W4s: Submitting Paperwork

To submit a completed W4 form, use the Create Paperwork Submission or PUT /paperwork/submissions endpoint. The endpoint accepts the following body parameters:

templateID: Unique identifier for the Paperwork Template (from previous step)worker_type: Type of worker (employee)companyID: Unique identifier for the companyemployeeID: Unique identifier for the employee (nullable if the worker type is contractor)contractorID: Unique identifier for the contractor (nullable if the worker type is employee)fields: The completed fields and values

Below is a JSON body example of a PUT /paperwork/submissions request:

{

"templateID": "123e4567-e89b-12d3-a456-426614174000",

"worker_type": "employee",

"companyID": "603d0f8f1c4b2a4e28c8f0b4",

"employeeID": "603d0f8f1c4b2a4e28c8f0b4",

"fields": {

"field1": "value1",

"field2": "value2"

}

} This will save the completed W4 paperwork submission for this employee.

W4s: Fetching Paperwork Submissions

You can always fetch the completed paperwork submission(s) using the Get Paperwork Submissions or POST /paperwork/submissions endpoint. The endpoint allows filtering by paperwork_type, companyID, jurisdiction_filter, and worker_filter.

Below is an example JSON response of a successful POST /paperwork/submissions request:

{

"success": true,

"data": [

{

"templateID": "123e4567-e89b-12d3-a456-426614174000",

"submissionID": "a1b2c3d4-e5f6-4a5b-8c7d-9e0f1a2b3c4d",

"submission_date": "2023-06-01T12:00:00Z",

"worker_type": "employee",

"companyID": "603d0f8f1c4b2a4e28c8f0b4",

"employeeID": "603d0f8f1c4b2a4e28c8f0b4",

"fields": {

"field1": "value1",

"field2": "value2"

},

"paperwork_type": "W4",

"url": "https://example.com/submission/12345"

}

]

}Add a Bank Account (optional)

NoteThis step is optional. If an employee is onboarded without bank account details they will still be able to receive employee checks by any disbursement method other than

direct_deposit.

To add a bank account for the employee call Create Bank Account to create the employee bank account.

curl --request POST \

--url https://api.zeal.com/bankaccount \

--header 'Accept: application/json' \

--header 'Authorization: Bearer {{testApiKey}}' \

--header 'Content-Type: application/json' \

--data '

{

"companyID": "{companyID}",

"id": "{{employeeID}}",

"institution_name": "Chase",

"account_number": "123456789",

"routing_number": "267084131",

"type": "checking"

}

'Update an employee's onboarded status

Call Set Onboarded Status to True to mark the employee status as onboarded.

curl --request POST \

--url https://api.zeal.com/employees/setOnboardedStatusToTrue \

--header 'Accept: application/json' \

--header 'Authorization: Bearer {{testApiKey}}' \

--header 'Content-Type: application/json' \

--data '

{

"employeeID": "{{employeeID}}",

"companyID": "{{companyID}}"

}

'Now that the employee's status is updated, they are considered onboarded.

White-Label

Access the Company Dashboard

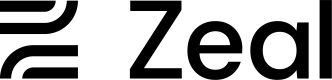

Navigate to your Partner Dashboard and ensure that Test Mode is enabled. Then, click on a Company to access the Company Dashboard as an Admin.

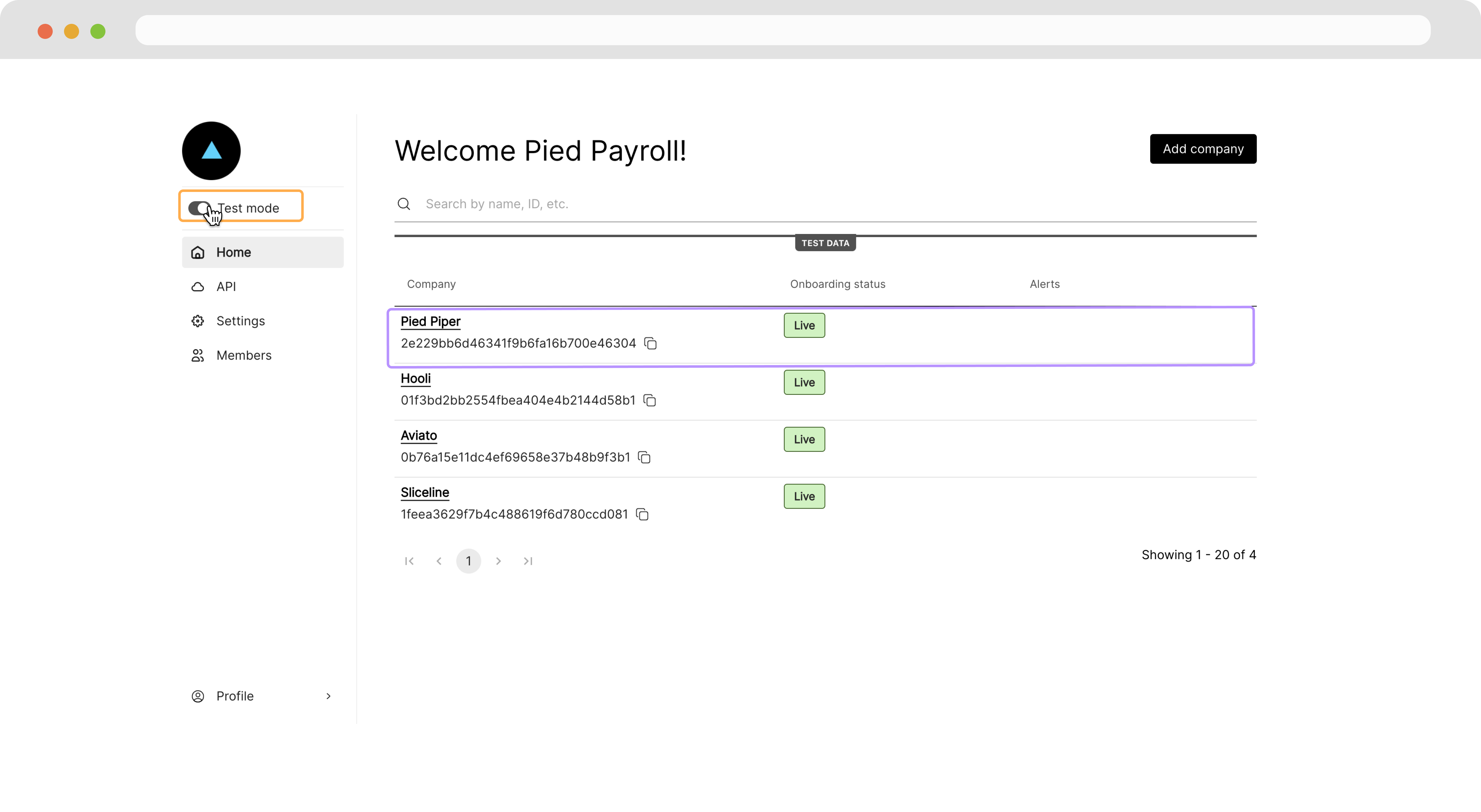

View a Work Location

Navigate to the Work Location page and ensure you have the location that the employee will be working at.

Create an Employee

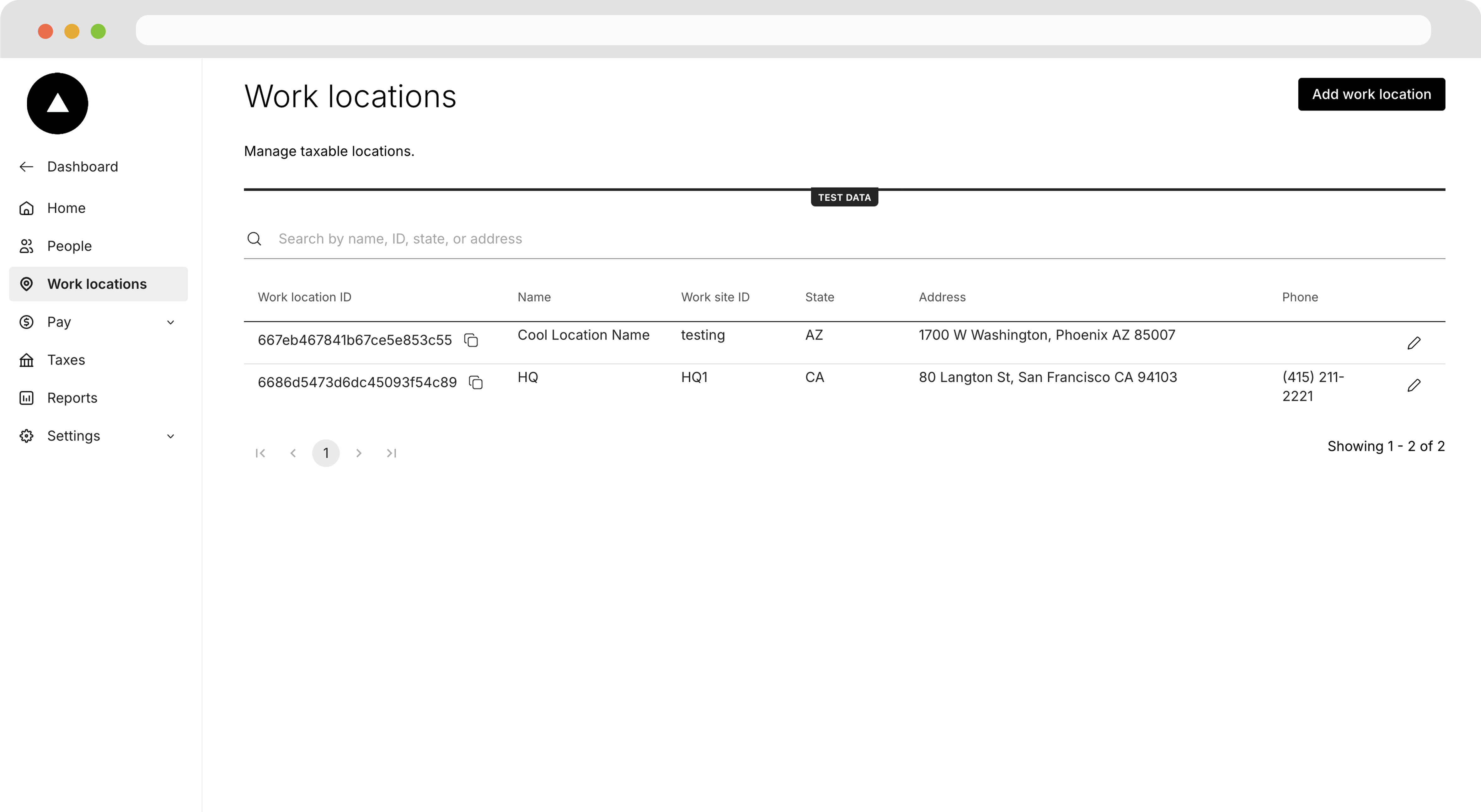

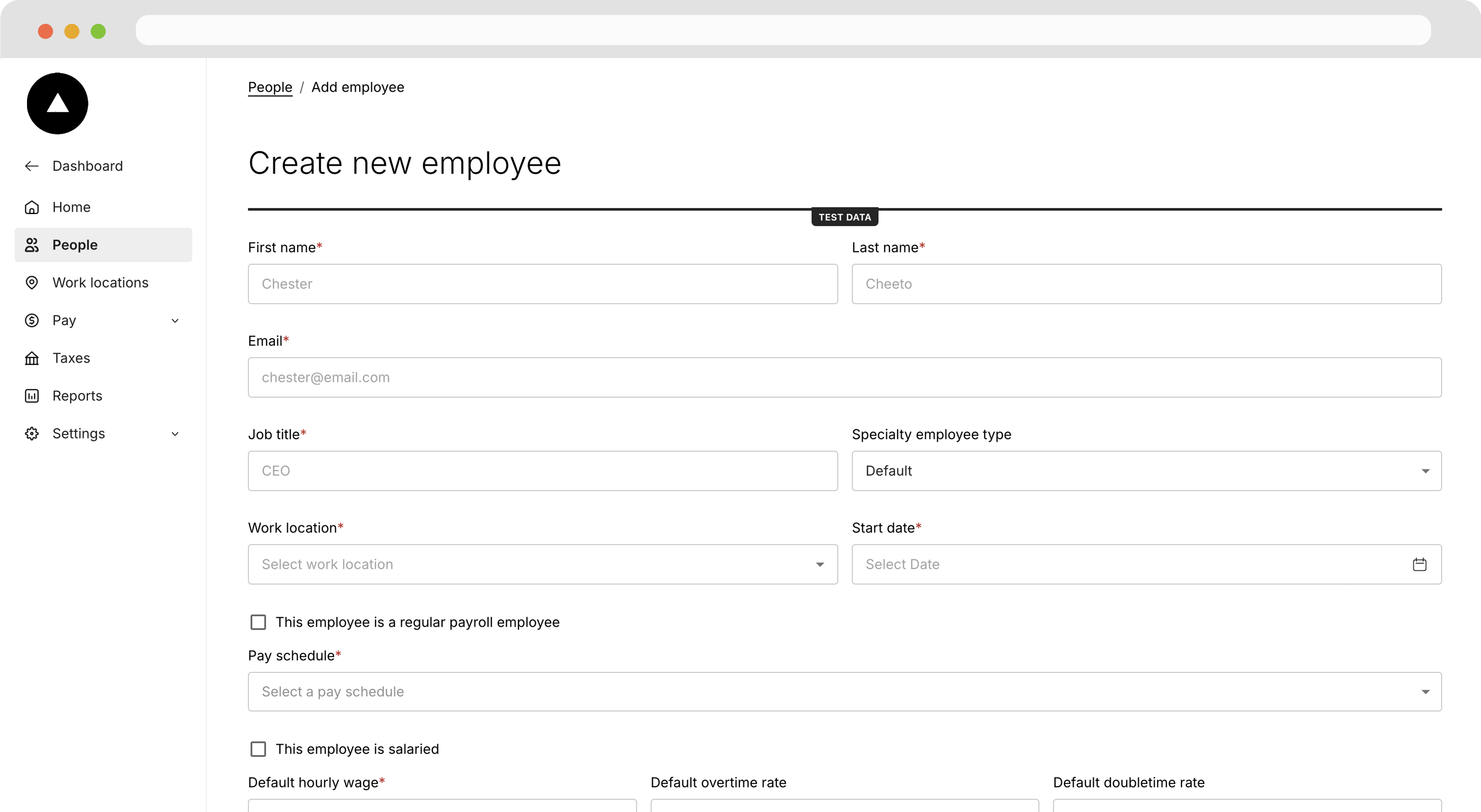

Next, navigate to the People page and click Add Employee.

Fill the employee information and select the proper Work Location from the dropdown, then click Add Employee.

Complete the onboarding flow

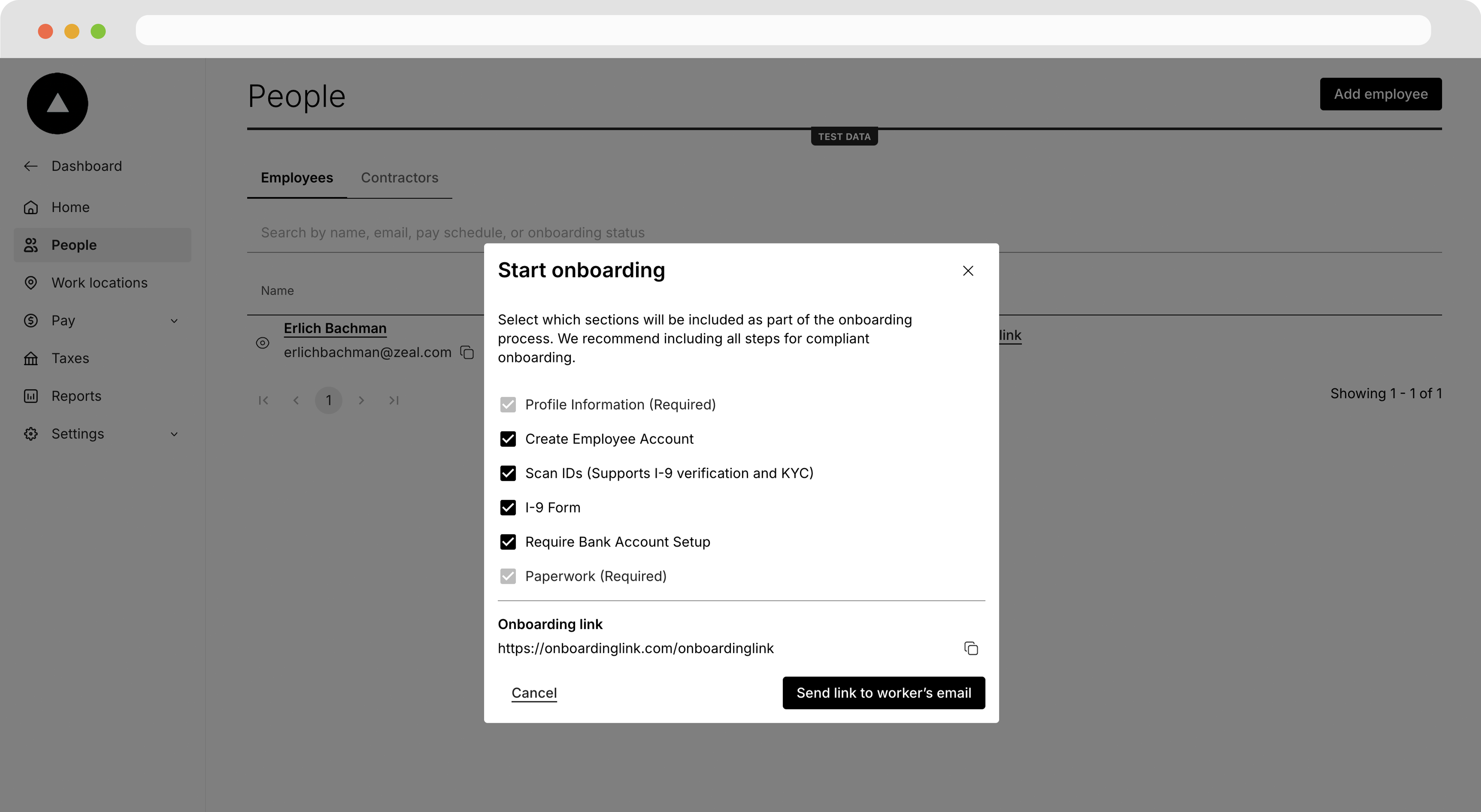

Back on the People page, find the Employee and click Copy onboarding link then Send link to employee's email.

TipThe link can also be accessed programmatically by calling Generate Employee Onboarding Link.

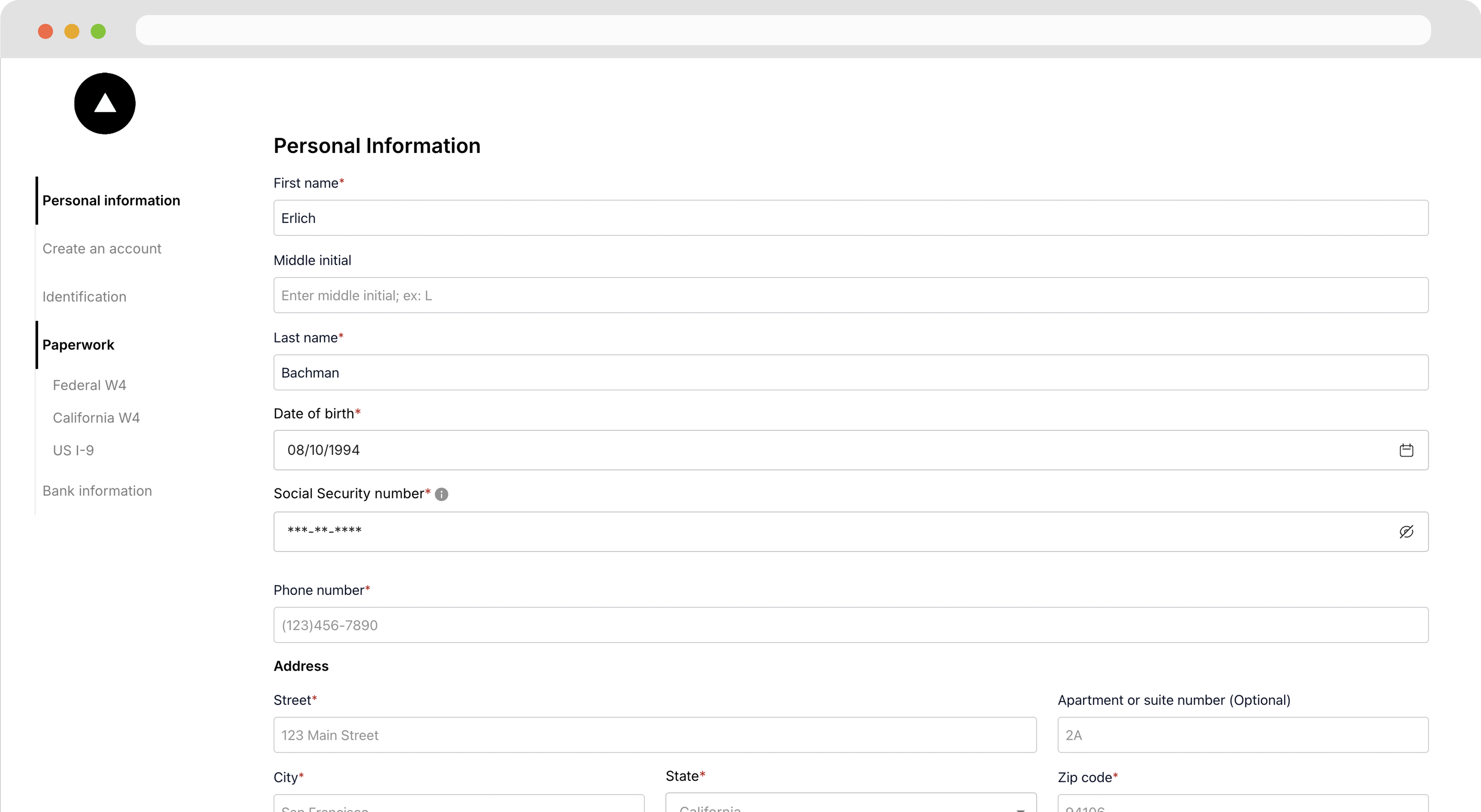

When the employee navigates to the page, they see the white-label component on your domain with your logo.

The employee completes the onboarding flow and they receive a congratulations message showing that they've been onboarded.

NoteWhen the Employee Onboarding flow is completed successfully through the white-label, Zeal sends the Employee information to the webhook URL you've set for the Employee Onboarding Event.

Recap

- To onboard an employee, personal information, work location, and W4 information need to be submitted.

- Bank account details don't need to be submitted, but the employee can't be paid by direct deposit without them.

- Companies can create Work Locations and employees from the Company Dashboard

- Employees can complete onboarding through the Employee Onboarding component

Updated 8 months ago

Now that we've onboarded our first employee, the next step is to pay them.